WEALTH AND INVESTMENT MANAGEMENT SERVICES

Comprehensive financial planning tailored to your needs.

Whether you need ongoing portfolio management or strategic financial guidance, we offer two ways to work together based on where you are today, customized for the path you want to walk down next.

A financial planner that treats you like a partner, not a transaction.

We don't believe in cookie-cutter advice or treating clients like account numbers. Our approach integrates tax planning, investment strategy, and financial guidance into a fully customized plan.

Ongoing Wealth Management

For individuals and families with $1M+ in investable assets who want comprehensive, tax-integrated financial planning and investment management.

This is our done-for-you service where we handle your complete financial picture. From portfolio optimization to tax strategy to retirement planning, everything is managed in one place with proactive communication throughout the year. You get weekly updates during onboarding and regular check-ins so you always know exactly where you stand.

-

Comprehensive portfolio management and rebalancing

Integrated lifetime tax planning and tax-efficient investing

Retirement income and distribution strategies

Estate planning coordination

Facilitation of charitable giving including donor-advised funds and qualified charitable distributions

Proactive market updates and guidance during volatility

Unlimited access for questions year-round

Quarterly check-ins

Regular financial reviews

Financial Planning Strategy

For those who need guidance on specific financial situations or want a clear roadmap they can implement themselves.

This service is for you if you prefer to manage your own finances but want professional guidance on specific decisions or need a roadmap strategy you can execute yourself. You get a comprehensive action plan and expert advice billed on the hour. Execute the plan on your own or hire us to implement it.*

*For projects estimated to run between 5-15 hours.

-

Clear roadmap with actionable steps you can implement

Targeted consultations on specific issues (debt management, retirement readiness, investment review)

Follow-up sessions available as your needs evolve

Access to CFP® and CPA expertise on your timeline

Confidence in your financial future begins here

•

Tax-smart financial planning

•

Holistic wealth management

•

Confidence in your financial future begins here • Tax-smart financial planning • Holistic wealth management •

What sets us apart

Dual CFP® & CPA Credentials

Personalized Management

Fee-Only Fiduciary

Responsive & Approachable

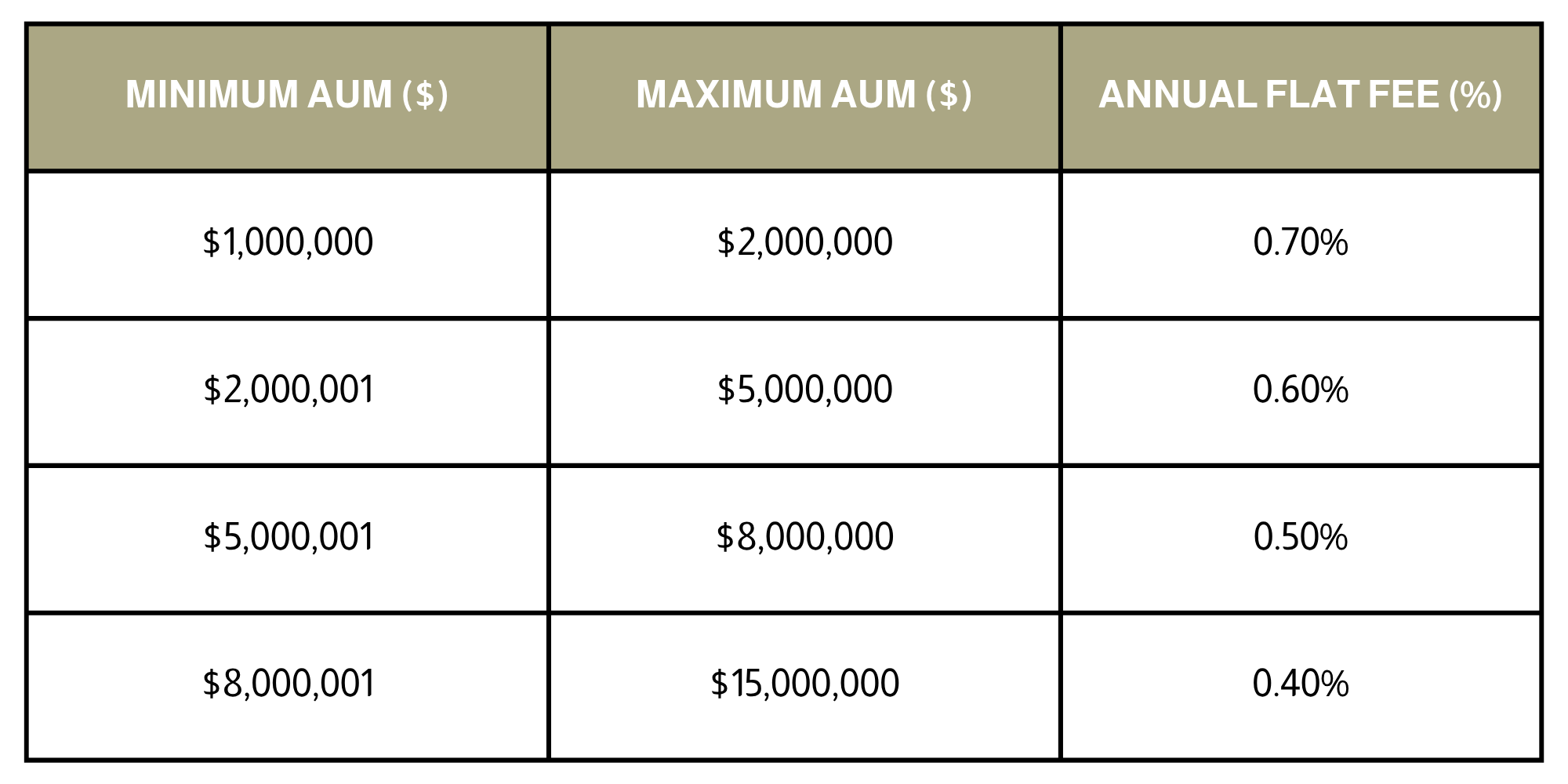

Fee-only wealth and investment management fee structure

As a fee-only fiduciary, we're legally required to put your interests first. We keep our fee structure fully transparent so that you know exactly what to expect. There are no commissions, no hidden costs, and no surprises.

Financial Planning Strategy

For targeted guidance or project-based work, we charge $300 per hour.

Most projects run between 5-15 hours depending on complexity. You'll receive a clear estimate upfront.

Ongoing Wealth Management

For clients with $1M+ in investable assets, our annual fee is based on a flat percentage of assets under management. As your portfolio grows, your flat fee percentage decreases.

How we work

We create real value from day one, and build on that foundation as you grow.

Discovery Session

We start with a one-hour strategy session to learn about your situation, answer your questions, and determine if we're a good fit.

Custom Strategy

We create a holistic wealth management plan tailored to your specific situation, complete with clear explanations of what we're doing and why.

Implementation

You can implement your plan yourself or work with us for long-term, ongoing management. If we work together long-term, I’ll provide proactive guidance and regular check-ins.

Ready to get started?

Book a $50 strategy session to discuss your financial situation and determine which service is the best fit for your goals.

Have questions about our services? Feel free to reach out directly to hello@corianderfg.com.

FAQs About Our Services

-

Ongoing Wealth Management is our done-for-you service for clients with $1M+ in investable assets. We handle your complete financial picture including portfolio management, tax strategy, retirement planning, and proactive guidance throughout the year.

Financial Planning Strategy engagements are for those who prefer to manage their own finances but want expert guidance on specific decisions or a comprehensive roadmap they can implement themselves. You get a detailed action plan and professional advice billed by the hour, with the flexibility to execute on your own or hire us for implementation.

-

Yes. I’m happy to partner with you for a Financial Planning Strategy engagement where we will create a plan for you to implement in order to meet your goals. You'll receive a clear estimate upfront for the expected hours and cost of the project.

-

No. As an independent Registered Investment Advisor (RIA), we are not beholden to any corporate sales goals, nor are we pressured to sell any particular product. The investments we choose and recommend are strictly in your best interests.

-

The only fee earned by Coriander Financial Group is the management fee that we invoice quarterly in arrears (after our services are performed for the quarter.). There are fees associated with investing in mutual funds, exchange-traded funds (ETFs), individual bonds and some foreign stocks called American Depository Receipts (ADR). These fees cannot be avoided regardless if they were purchased by us for you or any other investment advisor and they are not paid to Coriander Financial Group. These fees will be clearly disclosed when we discuss your investment plan.

-

Absolutely! We currently work with clients all over the country. Video conferencing, in addition to phone and email, have proven to be an effective way to maintain our professional relationships. Travel for face-to-face meetings is also an option in certain circumstances.